Article

IDN Financial Incentives: Impact on Treatment Prices?

March 22, 2024Authors

Topics

Navigating IDNs requires understanding their financial drivers, revenue streams, and cost management. Here, we look at IDNs' key financial aspects, such as revenue optimization strategies, and examine the potential effects of site-neutral payment reforms.

Introducing Emma Bijesse

Market Access Insights is pleased to introduce its newest team member – Emma Bijesse!

With over a decade of experience with health systems, Emma has had the privilege of providing strategic guidance and operational expertise to some of the top integrated delivery networks (IDNs), academic medical centers, and physician organizations across the country. At The Chartis Group, she led initiatives ranging from developing comprehensive oncology service line growth plans to implementing physician alignment strategies. Prior to consulting, Emma worked in the genetics department at Kaiser Permanente where she saw firsthand the impact of new treatment options for oncology patients.

As a part of the HMP MAI team, Emma looks forward to delving into research and developing insights on IDNs. Her experience of working at and consulting to IDNs will allow the MAI team to deliver fresh insights into the complexities and likely future trends of IDNs.

Given recent developments surrounding site-neutral payment reforms, Emma explores in this blog post IDNs’ revenue drivers and provides updates on site-neutral payment reforms. Navigating IDNs’ complexities requires a strong understanding of their financial drivers, revenue streams, and cost management strategies.

Overview of IDN Financials

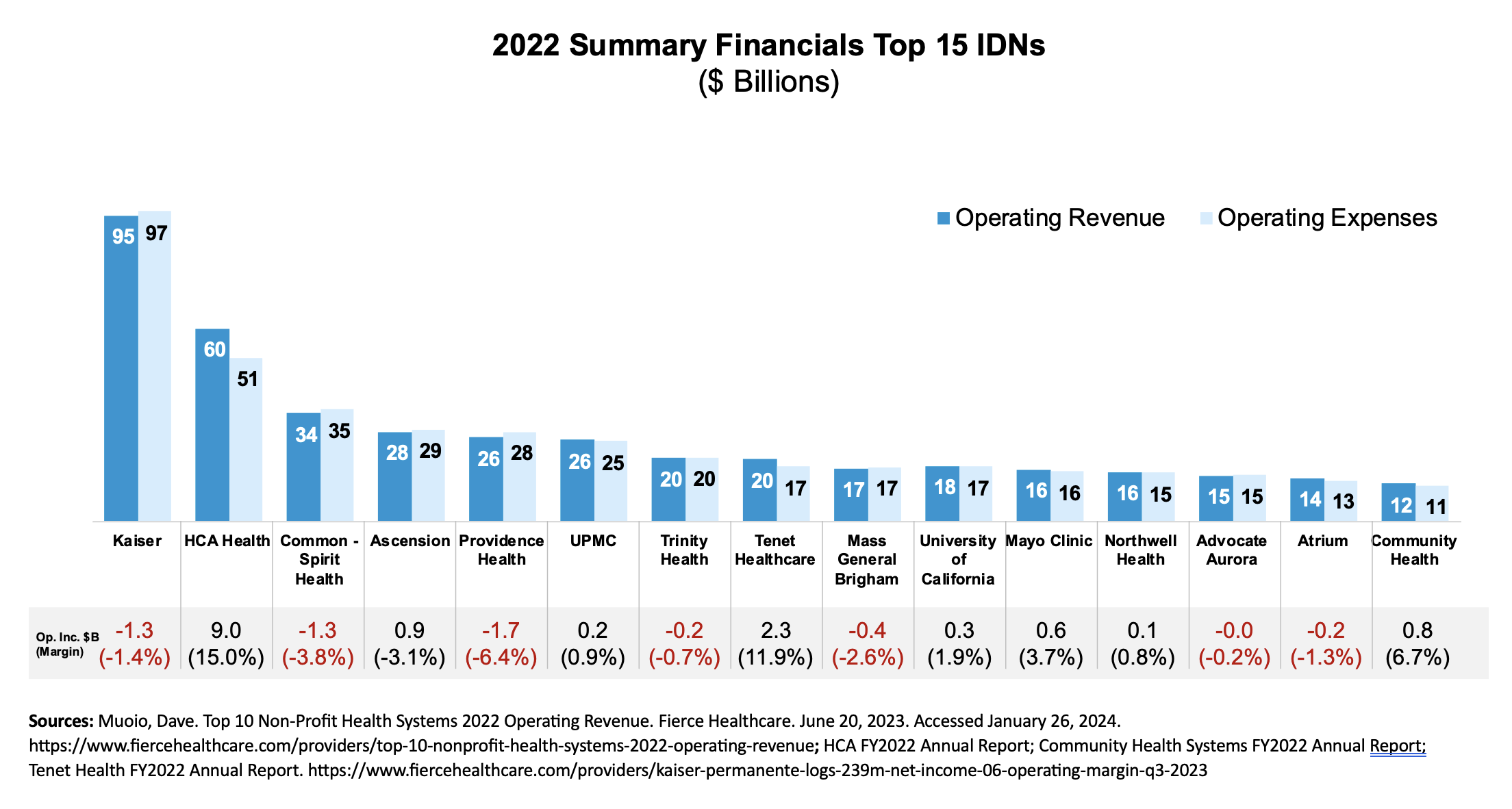

IDNs typically operate with razor-thin margins, often ranging between 0% and 3%. The chart below outlines the operating revenue and expenses for the top 15 IDNs in fiscal year 2022. While these organizations generate significant revenue, comparable to Fortune 500 companies, they also bear significant costs, both fixed and variable. Note that IDNs experienced some margin improvements in 2023, but lower margins persist as a common challenge.

IDNs continue to evolve, scale up, and diversify capabilities. Patient care remains their core business, and net patient service revenue (NPSR) remains their primary revenue source. Recent trends indicate a notable shift from inpatient to outpatient revenue streams, with outpatient NPSR surpassing inpatient NPSR for some IDNs. For example, the FY2023 income statement from CommonSpirit showed ~90% of revenue from patient care, 44% inpatient revenue and 46% outpatient revenue. IDNs continue to expand ambulatory services, invest in physician networks, optimize outpatient care, and diversify their businesses to adapt to this shift.

Labor typically accounts for the largest share of IDNs’ operating expenses and rising wages contributed to some of the financial challenges in 2022. For example, the FY2023 income statement from CommonSpirit showed ~51% of operating expenses were salaries and benefits and 15% were supplies, including drugs. Supplies, including drugs, constitute a smaller share of expenses; however, growth in drug expenses is outpacing other expenses. As drug costs continue to rise faster than other hospital expenses, they are poised to receive increasing attention from IDN leadership. HMP Market Access Insights’ 2023 IDN Report discusses some of the strategies IDNs employ to manage drug costs, and the upcoming 2024 IDN Report will further elaborate on this topic.

Key Revenue Optimization Strategies

IDNs employ multiple strategies to optimize revenue, with potential implications for drug manufacturers and patient treatment costs.

- Updating of Chargemasters: Chargemasters serve as the foundation for setting prices for all services and products offered by IDNs, including pharmaceuticals. Drug prices are determined based on markup ratios applied to average wholesale prices or wholesale acquisition costs. While Medicare and many commercial payers may no longer negotiate directly from hospital chargemasters for all products and services, research suggests that these list prices can still influence drug pricing for specific patient groups. Variances in chargemaster policies and markup ratios across different hospitals impact treatment costs depending on where patients receive care.

- Maximizing Collections: IDNs prioritize efficient management of collections to maximize revenue per case. Strategies include optimizing payer mix, negotiating favorable contracts with commercial payers, and monitoring and controlling charity care and bad debts. Even for commercially insured patients, prices can vary significantly based on contract negotiations between IDNs and payers.

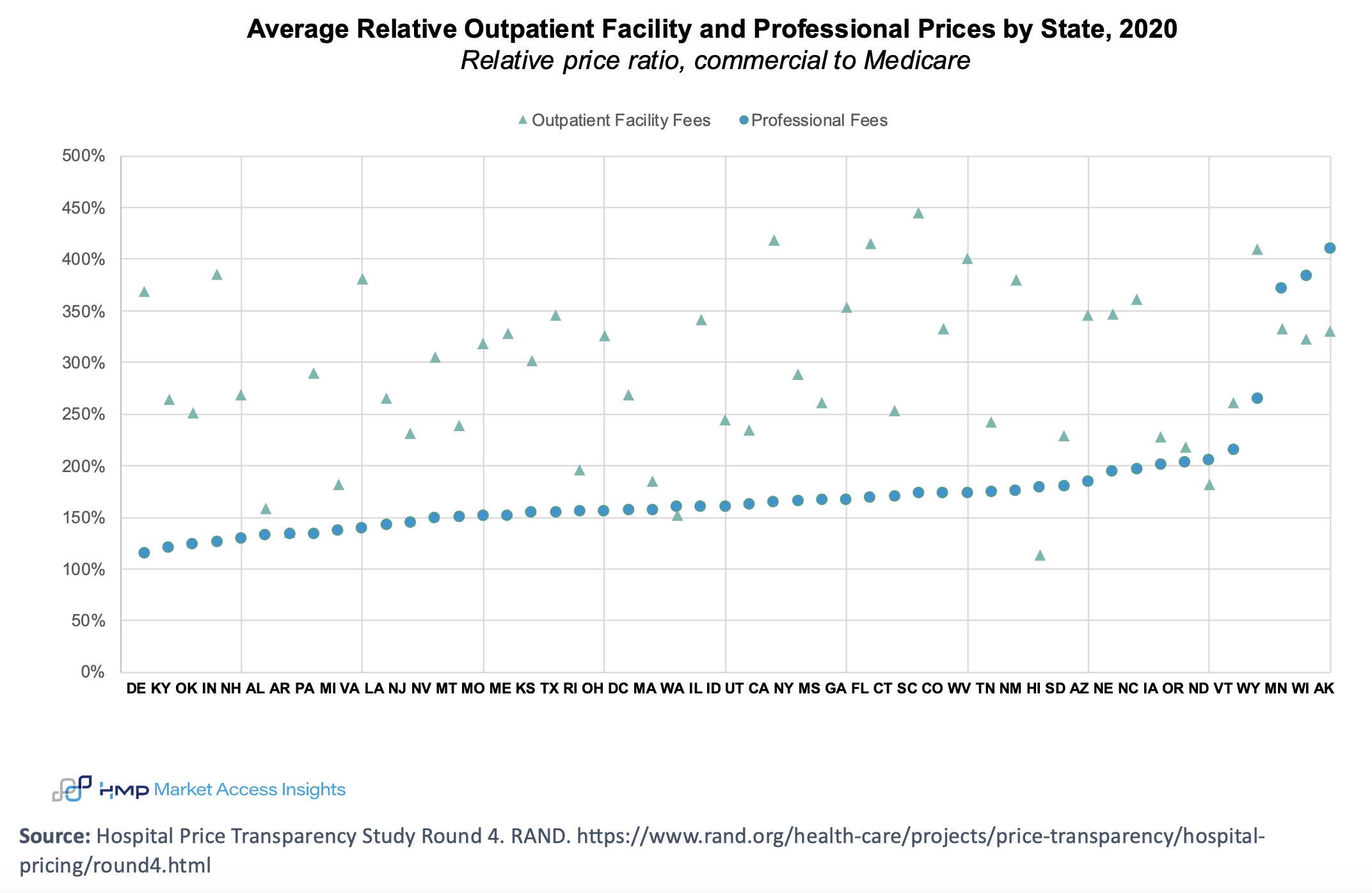

- Facilities Fees: IDNs may also charge different prices based on site of care. For care provided at a hospital or hospital outpatient department (HOPD), patients receive two bills: one from the physician for physician services and one from the hospital, including facilities fees meant to cover hospital overhead. If the same service is performed in a physician office or in a HOPD location, the IDN may generate more revenue from the same service performed in the HOPD location by charging facility fees in addition to the physician fee.

Recent findings from RAND displayed in the graph below underscore substantial variation in outpatient facilities fees across states and hospitals.

When considering different market access strategies, it is important for drug companies to understand the impact of these various revenue optimization strategies on the patient treatment costs, and their brands’ contribution to both cost and revenue.

Site-Neutral Payments

Discussion of site-neutral payment reforms has arisen due to disparities in reimbursement rates for health care services, such as infusions, based on the site of service (eg, HOPDs vs physician offices). In 2015, the Bipartisan Budget Act introduced significant site-neutral payment reforms. Notably, office-based physician practices acquired by hospitals after November 2015 are subject to the lower Medicare Physician Fee Schedule rates instead of the typically higher HOPD rates. This change effectively curtailed the practice of hospitals acquiring physician practices and converting them into HOPDs. Subsequent policy changes and regulatory initiatives have further promoted site-neutral payment reforms, including Medicare reducing reimbursement rates for certain services provided at HOPDs to align more closely with rates paid to physician offices.

More recently, there has been increased discussion and attention to site-neutral payment reform. In December 2023, the House passed the Lower Costs, More Transparency Act, which included provisions to establish uniform Medicare payments for medical infusions administered by physicians, regardless of the care setting. However, in February 2024, the Senate removed these site-neutral payment reform provisions.

It will be crucial to monitor site-neutral payment reforms closely and understand how any changes may affect the prices payers and patients pay for drugs at different care sites.

Stay tuned for our first landscape report of 2024, where we will explore the economic incentives of both IDNs and community oncology practices and the potential impact of these incentives on patients receiving oncology treatments.

The Latest

Article

Thought Leadership Whitepaper: How Will Medicare Drug Price Negotiations Really Impact Providers?

As manufacturers prepare for Medicare drug price negotiations, a critical question emerges: How will your provider engagement strategy evolve when Maximum Fair Prices (MFP) take effect in 2026?

Emma BijesseArticle

Meet Cindy: Data Integrity Expert and Pastry Connoisseur

One of Cindy’s favorite parts of working at HMP Market Access Insights is being part of a small, close-knit team. Collaborating with colleagues from different backgrounds has helped her expand her framework for viewing research.

Cindy ChenArticle

Meet Chris: Payer Oncology Expert and Insight Sleuth

Chris passionately dig deeply into research to uncover nuggets of information that can make a real difference. His favorite part of the job? Interacting with clients and helping them view challenges through a fresh lens.

Chris Van Denburg